In a landscape where digital innovation is reshaping industries from construction to entertainment, the design software sector has emerged as a powerhouse, particularly in the second quarter of 2024, with Procore Technologies (NYSE: PCOR) carving out a notable position among industry giants. This period has witnessed unprecedented demand for tools that facilitate intricate 2D and 3D designs, virtual reality experiences, and augmented reality applications, driving significant financial gains for key players. Companies like Procore, alongside peers such as PTC, Adobe, Autodesk, and Cadence Design Systems, have capitalized on this trend, collectively surpassing revenue expectations by an impressive 3.8%. This surge reflects not just technological advancement but also a broader economic environment that, despite its uncertainties, has largely favored growth in tech-driven sectors. As this analysis unfolds, the spotlight falls on Procore’s standout performance, juxtaposed against its competitors, revealing a sector ripe with opportunity and nuanced challenges.

Industry-Wide Success and Market Trends

Q2 Performance Highlights

The design software industry showcased remarkable resilience in Q2 of 2024, with six leading companies achieving a collective revenue beat of 3.8% against analyst estimates, underscoring a robust appetite for digital solutions. This achievement spans a variety of applications, from construction management tools to software for manufacturing and creative content. The surge in demand is fueled by the need for sophisticated design capabilities across sectors, enabling everything from architectural blueprints to immersive gaming experiences. Such widespread adoption signals a market that is not only thriving but also expanding its reach into new domains. This performance metric serves as a testament to the sector’s critical role in modern economies, where digital transformation is no longer optional but essential for competitiveness. As companies continue to innovate, the consistent outperformance against expectations highlights a sector that investors are keenly watching for sustained growth potential.

Beyond the headline figures, the Q2 results reveal a deeper story of adaptability and strategic focus among design software firms. The industry’s ability to cater to diverse needs—whether it’s streamlining construction workflows or enhancing product lifecycle management in manufacturing—has driven this collective success. Unlike other tech segments that may face fluctuating demand, design software benefits from a steady push toward digitization across industries. This trend is evident in how even niche players within the sector have managed to exceed financial forecasts, reflecting broad-based strength rather than isolated wins. Additionally, the integration of emerging technologies like virtual and augmented reality into design tools has opened new revenue streams, further bolstering the sector’s outlook. This dynamic environment suggests that the design software space is well-positioned to maintain its upward trajectory, provided it navigates external economic pressures effectively.

Economic Influences

The broader economic context of 2024 has significantly shaped the design software sector’s performance, with key developments like the Federal Reserve’s interest rate cuts in September and November providing a favorable backdrop. These reductions have eased borrowing costs for tech firms, allowing for increased investment in research and development, which is crucial for maintaining a competitive edge in a rapidly evolving field. Moreover, market sentiment received a boost following political events, notably Donald Trump’s presidential victory in November, which spurred a surge in major indices. This positive momentum has indirectly supported investor confidence in tech sectors, including design software. However, while these conditions have been largely beneficial, they also introduce layers of uncertainty as future policy directions remain unclear, potentially affecting long-term planning for these companies.

Another dimension of economic influence lies in the global push toward digital infrastructure, which has indirectly buoyed the design software industry. Governments and corporations worldwide are prioritizing digital tools to enhance efficiency, a trend that aligns perfectly with the offerings of companies in this space. Yet, looming uncertainties, such as potential shifts in trade policies or corporate tax structures, could pose challenges starting from 2025 onward. These factors create a complex environment where optimism must be tempered with caution. The Federal Reserve’s actions, while supportive now, may need reevaluation depending on inflation trends, and political outcomes could alter market dynamics in unforeseen ways. For the design software sector, staying agile amid these external forces will be critical to sustaining the impressive growth seen in Q2, ensuring that innovation continues to outpace potential economic headwinds.

Company-Specific Achievements

Procore’s Standout Results

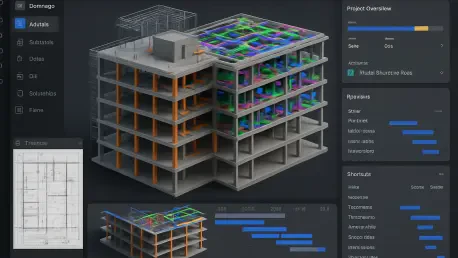

Procore Technologies (NYSE: PCOR) emerged as a formidable force in the Q2 earnings season of 2024, reporting revenues of $323.9 million, a substantial 13.9% increase year-over-year, and surpassing analyst expectations by 3.9%. Specializing in cloud-based construction management software, Procore has tapped into a critical need for streamlined project oversight in an industry often plagued by inefficiencies. This financial achievement is not merely a number but a reflection of the company’s ability to deliver value through digital transformation in construction, a sector increasingly reliant on technology for success. The revenue beat signals strong market acceptance of Procore’s solutions, positioning it as a leader in a niche yet vital segment of the design software landscape. Investors and industry observers alike are taking note of how such performance underscores Procore’s potential for sustained growth in a competitive market.

Equally impressive are Procore’s operational metrics, which further cement its standing in the industry during Q2 of 2024. Beyond revenue, the company outperformed expectations in EBITDA and annual recurring revenue, highlighting robust financial health and customer retention. These indicators suggest that Procore is not just growing but doing so sustainably, with a business model that ensures long-term client engagement. This strength in recurring revenue is particularly significant in the software-as-a-service space, where consistent income streams are a key measure of stability. Additionally, Procore’s focus on addressing specific pain points in construction—like real-time collaboration and data management—has resonated with its user base, driving adoption rates. This operational excellence, paired with financial gains, paints a picture of a company that is strategically aligned with market needs, ready to capitalize on the ongoing digital shift in construction workflows.

Comparative Analysis of Peers

Among Procore’s peers, PTC (NASDAPTC) stood out with an exceptional Q2 performance in 2024, posting revenues of $643.9 million, a striking 24.2% year-over-year increase, and beating analyst forecasts by 10.4%. Focused on manufacturing design and product lifecycle management, PTC’s results reflect a booming demand for industrial design solutions, outpacing even Procore’s impressive growth. Meanwhile, Autodesk (NASDAADSK) reported a 17.1% revenue rise to $1.76 billion, with a 2.3% beat on expectations, and saw its stock price jump by 10.4%, signaling strong investor approval. In contrast, Adobe (NASDAADBE), with a focus on digital content creation, recorded a more modest 10.7% revenue growth to $5.99 billion, beating estimates by just 1.4%, indicating varied dynamics across different market segments. These disparities highlight how specialized focuses drive distinct outcomes within the broader design software industry.

Delving deeper into the comparative landscape, Cadence Design Systems (NASDACDNS) also showcased solid growth in Q2 of 2024, with revenues of $1.28 billion, up 20.2% year-over-year, and a 1.8% beat on expectations. Its emphasis on computational software for electronic system design aligns with the rising complexity of semiconductor needs, contributing to a 4.1% stock price increase post-earnings. Unlike Adobe’s relatively softer performance, which may reflect saturation or competition in creative software markets, companies like PTC and Autodesk benefit from industrial and engineering applications experiencing rapid tech adoption. This variation among peers underscores a sector where innovation in specific niches can yield outsized gains, even as broader technological trends lift the entire industry. The diverse outcomes also suggest that while Procore excels in construction, other segments like manufacturing and electronics design are equally pivotal to the sector’s overall strength.

Investor Sentiment and Future Outlook

Stock Price Movements

Following the Q2 earnings announcements in 2024, the design software sector saw an average stock price increase of 4.4%, reflecting generally positive investor sentiment toward the industry’s growth prospects. Procore Technologies experienced a modest uptick of 1.9% in its stock price, reaching $72.69, which indicates steady but not overwhelming market confidence in its performance. In stark contrast, Autodesk led the pack with a significant 10.4% surge, trading at $318.90, a clear sign of strong investor approval of its robust revenue growth and operational metrics. These movements collectively suggest that the market views design software as a promising investment area, with varying degrees of enthusiasm depending on individual company results. The overall upward trend in stock prices points to a sector perceived as resilient and capable of delivering consistent value amid economic fluctuations.

Further analysis of stock price reactions reveals nuanced investor perceptions across the sector in Q2 of 2024. While PTC reported the highest revenue growth among peers, its stock price remained flat at $203, hinting that the market may have already priced in its strong performance prior to the earnings release. Similarly, Adobe’s unchanged stock price at $347.32, despite a revenue beat, suggests that investors expected more significant outperformance or are cautious about its growth trajectory in the creative software space. Cadence Design Systems, however, saw a 4.1% increase to $347.30, aligning with its solid financial results. These varied responses underscore that investor confidence is not solely tied to revenue figures but also to future potential and market positioning. For the design software industry, such stock dynamics illustrate a complex interplay of expectations and actual performance, shaping how each company is valued in the public market.

Forward-Looking Guidance

Looking ahead from the Q2 results of 2024, most design software companies, including Procore Technologies, have provided revenue guidance for the next quarter that aligns closely with analyst expectations, signaling a stance of cautious optimism. Procore’s projections reflect a balanced outlook, suggesting confidence in sustained demand for its construction management solutions without overpromising amid potential economic shifts. This approach mirrors the broader industry trend, where firms are mindful of maintaining credibility with investors by setting achievable targets. The alignment with forecasts indicates a mature sector that understands the importance of steady growth over speculative leaps, especially in a market where digital tools are becoming indispensable. Such guidance offers a glimpse into how these companies anticipate navigating the immediate future, balancing innovation with pragmatic financial planning.

However, the forward-looking statements also come with an acknowledgment of potential challenges looming from 2025 onward, particularly related to economic and policy uncertainties. Possible changes in trade regulations or corporate tax policies could impact operational costs and market access for design software firms, introducing variables that current guidance cannot fully predict. Despite these concerns, the sector’s overall outlook remains positive, underpinned by the persistent global shift toward digitization across industries. Companies are likely to continue investing in emerging technologies like augmented reality and cloud-based platforms to stay competitive, as seen in Procore’s strategic focus. This cautious yet hopeful perspective suggests that while immediate quarters may see steady progress, the industry is preparing for adaptability in response to external pressures, ensuring that growth in design software remains a long-term narrative of resilience and opportunity.