In a seismic shift for the tech industry, Google has unveiled a staggering $32 billion all-cash acquisition of Wiz, a trailblazing cloud security company, marking one of the largest deals of its kind and setting a new benchmark for innovation in the sector. This bold maneuver is poised to reshape the landscape of multicloud security, an area of growing concern as enterprises increasingly rely on a mix of cloud providers such as AWS, Microsoft Azure, and Google Cloud to power their operations. The urgency for robust, seamless security solutions has never been more pronounced, with businesses grappling with complex vulnerabilities across these diverse environments. Wiz’s innovative platform, known for its agentless approach and real-time threat detection, emerges as a critical asset in addressing these challenges. For Google, this acquisition isn’t just a financial transaction but a strategic leap to elevate its cloud division’s competitiveness in a market where it has historically trailed its rivals. Yet, with a hefty price tag and potential regulatory roadblocks ahead, the path to realizing this vision is fraught with uncertainty.

Strategic Implications for Google Cloud

Elevating Google Cloud’s Market Position

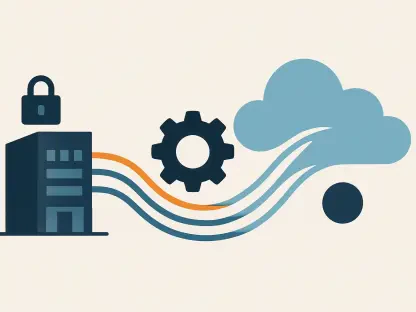

The acquisition of Wiz represents a calculated move by Google to strengthen its foothold in the public cloud arena, where it has long lagged behind giants like AWS and Microsoft Azure. With a market share that pales in comparison to its competitors, Google Cloud has struggled to carve out a dominant position despite significant investments and growth. Integrating Wiz’s advanced security platform offers a chance to differentiate its offerings by addressing a pressing need among enterprises—securing multicloud environments. As businesses adopt hybrid strategies that span multiple providers, the demand for cohesive security solutions has surged. Wiz’s technology, trusted by over half of Fortune 100 companies, provides a robust framework for identifying and mitigating risks in real time. This could attract a broader customer base to Google Cloud, positioning it as a serious contender in a space where security is often the deciding factor for adoption. The deal signals a clear intent to close the competitive gap and redefine Google Cloud’s role in the industry.

Beyond merely enhancing its portfolio, this acquisition aligns Google Cloud with the broader industry shift toward multicloud strategies, where security serves as the linchpin for successful implementation. The ability to offer a comprehensive solution that seamlessly integrates across diverse cloud platforms could set Google apart from rivals who may lack such specialized capabilities. Wiz’s proven track record, evidenced by its $700 million in Annual Recurring Revenue (ARR), underscores its value as a strategic asset. For enterprises navigating the complexities of data protection across fragmented systems, Google Cloud could become a go-to provider, leveraging Wiz’s expertise to build trust and reliability. However, the success of this strategy hinges on effective integration and the ability to market these enhanced capabilities to a skeptical audience. If executed well, this move might not only boost Google Cloud’s market share but also reshape perceptions of its commitment to enterprise-grade security in an increasingly competitive landscape.

Financial and Investor Impact

Scrutiny surrounds the financial dimensions of this $32 billion deal, particularly given Wiz’s lack of profitability despite its impressive revenue figures. Valued at a revenue-to-enterprise multiple ranging from 45x to 65x, the acquisition reflects Google’s lofty expectations for the long-term strategic benefits of Wiz’s technology. Such a premium raises questions about whether the financial justification holds up under closer examination, especially in an economic climate where tech valuations are often debated. While Wiz’s growth trajectory is undeniable, with significant adoption among top-tier enterprises, the absence of immediate profitability introduces a layer of risk. Google’s willingness to pay such a steep price suggests confidence in future returns, but it also places immense pressure on the integration process to deliver measurable value. Stakeholders will be watching closely to see if this gamble pays off or if it becomes a cautionary tale of overvaluation in the tech sector.

Equally significant is the impact on Wiz’s investors, who stand to gain substantially from this acquisition. Prominent backers such as Sequoia and Salesforce Ventures are poised for a lucrative exit, with the deal reportedly doubling Wiz’s valuation from its last funding round. This windfall highlights the high stakes and high rewards of investing in innovative cybersecurity startups, particularly those addressing critical needs like multicloud security. For the broader investment community, the transaction sends a strong signal about the value placed on cutting-edge security solutions in today’s market. However, it also prompts a deeper discussion about sustainability and whether such valuations can be maintained in the face of regulatory and operational challenges. The financial narrative of this deal is one of optimism tempered by caution, as the industry weighs the potential for transformative growth against the very real possibility of unforeseen hurdles that could alter the expected outcomes.

Technological and Industry Trends

Innovation in Cloud Security

At the heart of Wiz’s appeal lies its groundbreaking agentless security platform, a technology that sets it apart in the crowded cybersecurity field. Unlike traditional solutions that require cumbersome agent deployments, Wiz offers real-time visibility and control across multicloud environments without adding operational overhead. This innovation addresses a critical pain point for enterprises managing sprawling cloud infrastructures, allowing them to detect vulnerabilities and misconfigurations instantly. Founded by cybersecurity veterans, including CEO Assaf Rappaport, Wiz has built a reputation for simplicity and effectiveness, earning the trust of major corporations. For Google Cloud, integrating this technology could redefine how enterprises approach cloud security, offering a streamlined alternative to more invasive methods. The focus on agentless deployment reflects a broader industry push toward solutions that prioritize ease of use while maintaining robust protection, a trend that is likely to shape the future of the sector.

Another dimension of innovation driving this acquisition is the growing integration of artificial intelligence in threat detection and mitigation. Wiz’s platform embodies the industry’s shift toward smarter, proactive security measures that leverage AI to anticipate and neutralize risks before they escalate. This aligns with a wider movement in cybersecurity, where manual processes are increasingly replaced by automated, data-driven systems capable of handling the scale and complexity of modern threats. Google’s investment in Wiz signals a bet on this technological evolution, positioning Google Cloud to lead in delivering cutting-edge solutions that meet the sophisticated demands of today’s enterprises. As cyber threats become more dynamic, the ability to stay ahead through AI-driven insights will likely become a key differentiator. This deal not only enhances Google Cloud’s technical capabilities but also places it at the forefront of a transformative wave in how security is conceptualized and implemented across the industry.

Consolidation vs. Competition

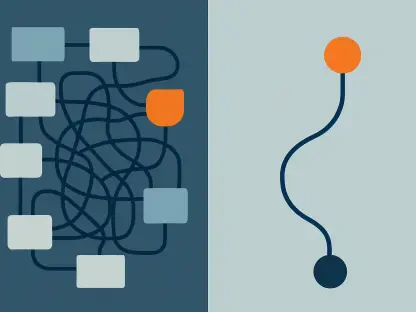

The acquisition of Wiz by Google underscores a persistent trend of consolidation within the tech industry, where large players absorb innovative startups to bolster their competitive arsenals. This strategy, while effective for rapidly scaling capabilities, raises questions about the long-term health of innovation in the cybersecurity space. By integrating Wiz’s specialized multicloud security platform, Google aims to fortify its position against AWS and Microsoft Azure, who have similarly pursued acquisitions to expand their offerings. However, such moves can create an environment where smaller, agile firms struggle to compete with the resources and reach of tech giants. The pattern of consolidation, evident in this $32 billion deal, suggests a market increasingly dominated by a handful of major players, potentially narrowing the diversity of solutions available to consumers. The balance between growth through acquisition and fostering independent innovation remains a critical issue for the industry to navigate.

On the flip side, this deal also intensifies competition in the public cloud market, where security has emerged as a battleground for differentiation. Google’s move to acquire Wiz is a direct challenge to competitors, signaling an aggressive push to capture enterprise clients who prioritize robust multicloud protection. Yet, as tech giants consolidate their power, there’s a lingering concern about whether such acquisitions might inadvertently stifle the very innovation they aim to harness. The absorption of a company like Wiz, known for its cutting-edge approach, into a corporate behemoth could limit the risk-taking and experimentation that often drive breakthroughs in cybersecurity. Additionally, with the deal’s closure anticipated in 2026 and potential antitrust scrutiny on the horizon, regulatory dynamics could further complicate the competitive landscape. The tension between consolidation and competition reflects a broader industry dilemma, where the pursuit of market dominance must be weighed against the need to preserve a vibrant, innovative ecosystem.

Reflecting on a Pivotal Moment

Looking back, Google’s $32 billion acquisition of Wiz stood as a defining chapter in the evolution of cloud security, highlighting both the immense potential and the inherent risks of such a monumental deal. The integration of Wiz’s agentless, AI-enhanced platform into Google Cloud marked a significant step toward addressing the complex security demands of multicloud environments. Despite the strategic alignment with industry trends, the steep valuation and prolonged regulatory process, which extended to 2026, underscored the challenges of executing large-scale acquisitions in a tightly scrutinized sector. As the dust settled, the focus shifted to actionable next steps for stakeholders—ensuring seamless technology integration, navigating regulatory landscapes, and maintaining a commitment to innovation. The broader industry was left to ponder how to balance the benefits of consolidation with the need to nurture independent creativity, setting the stage for ongoing dialogue about the future of cybersecurity in an era of rapid transformation.