A bold declaration from Ali Ghodsi, the chief executive of the $62 billion data and AI company Databricks, suggests that the very foundation of modern enterprise technology, the Software-as-a-Service model, is facing an existential crisis. He posits that the era of navigating pre-built applications through clicks and menus is drawing to a close, destined to be supplanted by a new paradigm driven by autonomous AI agents. This vision is not one of a sudden apocalypse for SaaS but rather a gradual slide into irrelevance, as the core value proposition of enterprise software shifts from static, pre-defined workflows to dynamic, on-demand intelligence. This perspective carries significant weight, as it comes from a leader whose company is strategically positioned not just to witness this transformation but to actively architect its future, placing the control of data at the epicenter of the next technological revolution.

The Dawn of a New Paradigm: From Clicks to Commands

The “Prompt-and-Execute” Revolution

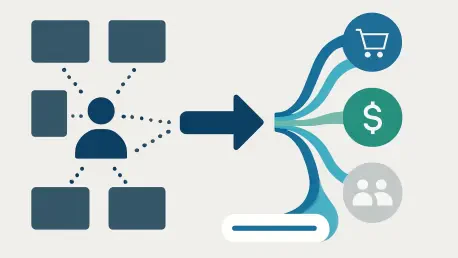

The fundamental argument for the obsolescence of SaaS rests on a profound shift in user interaction, moving from a “point-and-click” environment to a “prompt-and-execute” model. For decades, enterprise software, from customer relationship management platforms like Salesforce to human resources systems like Workday, has been defined by its graphical user interfaces. These systems are essentially collections of pre-determined workflows, constraining users to the paths envisioned by their developers. Ghodsi’s predicted future replaces this rigid structure with fluid, conversational interaction. In this new world, a user would express a complex, multi-step business need in simple natural language—for instance, “Generate a quarterly sales forecast for the Northeast region, identify the top three performing representatives, and draft a congratulatory email to them.” An intelligent agent would then autonomously interpret this request, access the necessary data from disparate enterprise systems, execute the entire workflow, and deliver the final output without human intervention, rendering the traditional application interface a “vestigial organ.”

This impending transition represents more than just a new interface; it signals a complete redefinition of how work is accomplished within an organization. The current software model forces knowledge workers to act as human APIs, manually bridging the gaps between siloed applications to complete complex tasks. An AI agent, however, can operate across these boundaries seamlessly, orchestrating processes that currently require hours of manual effort and context-switching. The true power of the prompt-and-execute model lies in its ability to understand intent and context, allowing it to assemble and execute novel workflows on the fly. This moves the user’s focus from process execution to outcome definition, fundamentally elevating the nature of knowledge work. The implication is that the software itself becomes invisible, with the agent acting as a direct, intelligent intermediary between the user’s goal and the underlying data and systems required to achieve it, thereby diminishing the value of the application layer that sits in between.

The Strategic Pivot to Data

This prediction of a SaaS sunset is inextricably linked to Databricks’ overarching corporate strategy, which is built on the principle of “data gravity.” This concept posits that as an organization consolidates more of its data onto a single, unified platform, that platform becomes the natural center for analytics, applications, and intelligence. Ghodsi is effectively arguing that as the value migrates away from the siloed application layer of traditional SaaS, it will reconcentrate in the foundational data layer. Since highly effective and autonomous AI agents require unified access to vast quantities of clean, well-governed, and up-to-date data, the platform that houses this data inherently becomes the most critical component of the enterprise technology stack. By positioning its data lakehouse as the essential substrate for building and running these future agents, Databricks is making a calculated bet that whoever owns the data will ultimately own the future of enterprise software.

This strategic maneuver aims to create a powerful and enduring competitive moat. In the current SaaS landscape, data is often fragmented and locked within the proprietary ecosystems of various vendors, creating significant barriers to building holistic, intelligent systems. A unified data platform breaks down these silos, providing a single source of truth that can fuel more sophisticated AI agents capable of understanding the entire business context. This concentration of data not only makes the platform sticky—as migrating massive datasets is complex and costly—but it also creates a virtuous cycle. Better data enables the development of smarter agents, which in turn deliver more value, encouraging organizations to bring even more data onto the platform. This logic frames the future not as a battle between applications, but as a battle for data supremacy, with the ultimate prize being control over the intelligence that will power the next generation of enterprise operations.

The Battle for the Agent Layer

A Three-Way Race for Dominance

The transition toward an agent-centric ecosystem has ignited a high-stakes competition to determine who will own the “agent layer,” a technological stratum that will direct the flow of hundreds of billions of dollars in future IT spending. The competitive landscape is coalescing into three primary camps, each with a distinct strategy. First are the SaaS incumbents, including giants like Salesforce with its Agentforce platform and Microsoft with its Copilot agents. Their approach is fundamentally defensive; they aim to build agentic capabilities on top of their existing platforms, arguing that AI will augment rather than replace their core offerings. Their narrative is one of evolution, where agents make their established tools more powerful and intuitive, thereby reinforcing the value of their ecosystems and protecting their massive customer bases from disruption. They leverage deep domain expertise and entrenched customer relationships as their primary competitive advantages.

Challenging the incumbents are the data platform challengers, led by Databricks and its chief rival, Snowflake. These companies are championing the more radical vision that agents will be built directly upon foundational data platforms, bypassing the traditional SaaS layer entirely. Snowflake, for its part, is aggressively investing in its Cortex AI suite to enable native agentic capabilities within its data cloud, mirroring Databricks’ strategy. The third and perhaps most formidable camp consists of the hyperscale cloud providers: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Leveraging their immense scale, vast infrastructure, proprietary foundation models like those offered through AWS Bedrock and Google Vertex AI, and deep enterprise relationships, the hyperscalers are building comprehensive platforms that could potentially subsume the roles of both specialized data companies and SaaS vendors, offering a one-stop-shop for data, AI model development, and agent deployment.

A Reality Check: Skepticism and Hurdles

Despite the conviction behind Ghodsi’s vision, it is met with significant skepticism from many industry veterans who see a more evolutionary path forward. A consensus view among SaaS leaders, articulated by figures like Marc Benioff of Salesforce, is that AI will serve as a powerful enhancement to, not a replacement for, existing platforms. They contend that agents, for all their potential, will still require the structured data, robust governance frameworks, security protocols, and complex compliance guardrails that mature SaaS applications have spent decades perfecting. These systems provide the essential rails on which agents can safely and reliably operate, managing everything from access controls to audit trails. From this perspective, the notion of entirely replacing these proven systems with autonomous agents is seen as both impractical and risky, ignoring the immense value embedded in the existing application layer.

Beyond the strategic counterarguments, the path to a fully agent-driven enterprise is fraught with formidable practical barriers that will temper the pace of adoption. Enterprises are inherently conservative, especially when it comes to mission-critical business processes. The leap of faith required to entrust an autonomous AI agent with high-value functions—such as executing multi-million-dollar procurement orders, managing sensitive financial compliance workflows, or handling critical customer data—is enormous. Significant and unresolved challenges surrounding security, liability, transparency, and auditability remain. How can an organization ensure an agent’s actions are secure? Who is accountable when an agent makes a costly error? How can its decisions be audited for regulatory compliance? These complex questions mean that the enterprise adoption curve for advanced autonomous agents will likely be measured in years, not months, requiring a gradual build-up of trust and the development of new governance frameworks.

An Inevitable Shift in Value

The debate over the future of enterprise software, catalyzed by the rise of generative AI, ultimately centered on where technological value would accrue in the coming decade. The arguments put forth by leaders from both the established SaaS world and the disruptive data-centric challengers highlighted a fundamental realignment. While the timeline remained a subject of intense discussion, the underlying shift from static applications to dynamic, intelligent systems was widely acknowledged as the definitive direction of the industry. For enterprise technology buyers, this realization prompted a strategic pivot away from simply procuring siloed applications and toward building a cohesive, modern data infrastructure. The understanding was that organizations with a clean, accessible, and unified data foundation were best positioned to capitalize on the coming wave of AI agents, regardless of which vendor ultimately won the platform wars. This strategic preparation laid the groundwork for a future where competitive advantage was derived not from the software one used, but from the intelligence one could deploy.